Are you aiming for financial freedom or simply hoping for a peaceful retirement? Investing is a need, no matter what your long-term objectives are. However, it might not be easy to know where to begin. This is where the top investing apps come into play.

Beginners can use investing apps to get their feet wet in the market, while more seasoned investors can save money by working with investing apps instead of traditional financial consultants. A good investment software is essential if you plan to do any investing on your own.

Here are a few of the best, so you can decide which is ideal for you.

Investing in Apps Has Its Perks

Investing in apps is quite valuable, but it’s crucial to know why before diving into the best ones.

- Save money by avoiding fees. It’s possible to save a lot of money by using low-cost and free investment tools and platforms.

- Could you put it in and forget it? With Robo advisors and automated brokerages, your money is put on autopilot.

- Consult with a professional for assistance. By using digital tools, you may invest like a pro without paying the price tag.

- Make sure you know where your money is going before you spend it. Many investing applications and platforms offer bespoke dashboards and specialized feedback to get a clear picture of how your investments are doing.

- You have access to all of your money. Convenience is increasingly important to consumers when it comes to managing their finances. Having all of your investments stored in an easy-to-use app is essential to make investing easier and more pleasant.

Top Investing Apps for 2022:

Some of the most popular investment tools have been analyzed by us to come up with our top 10 list of the best investing apps. Using a Roth IRA, you can benefit from tax advantages and low-cost index fund / ETF options using these apps.

Discover the best features of these products by reading on.

Vanguard

Vanguard is an essential part of any list of the best investment apps.

It’s no surprise that Vanguard quickly became a fan favorite because of the success of index funds in helping people become millionaires. Low-cost funds are available through Vanguard, which removes the guesswork from investing.

By investing in index funds, you can avoid making educated guesses about particular stocks or putting together your portfolio (although you can do that with Vanguard, too!). Index funds reflect market indices.

Vanguard is notable for the low costs it charges investors and for another factor. With Vanguard, you are more than just a stockholder. You’re also a business owner. That means that Vanguard does not have to choose between its clients’ needs and the needs of its shareholders–the two are inseparable.

Find out more about why Vanguard is so highly regarded in personal finance.

Fidelity

Like Vanguard, Fidelity is a financial services firm. In reality, the choice between the two is often a matter of personal preference because they are so similar.

Low- and no-fee funds are available from Fidelity. As a result, these funds allow you to diversify and protect yourself from market volatility.

The cherry on top? Once you’ve invested, you can automate future transactions to keep everything running smoothly in the background. You can also check the jobs paying 20 an hour.

Are you looking for more hands-on investment choices as an experienced investor? You’re in good hands with Fidelity. In addition, they offer free trading commissions and a wide range of research tools to their customers. For a more personalized investment experience, you can configure the user dashboard.

Find out more about Fidelity’s products and services here.

Also Check – A Comprehensive Guide On Real Estate Peer To Peer Lending

M1 Finance

When M1 Finance debuted in 2015, it rocketed into the personal finance industry. M1 Finance, despite being a relative newcomer, already manages $5 billion in assets.

Even if you can’t afford to buy a whole share of a company or ETF, you can still invest in a percentage of it.

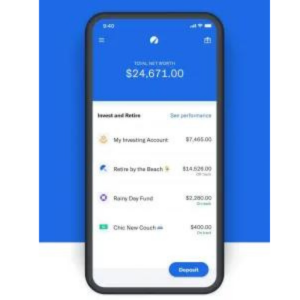

Whatever your financial goals, M1 Finance can help you achieve them. They provide a wide range of portfolio-building choices, including access to approximately 100 expert portfolios. With their easy-to-use dashboard, you can keep tabs on the progress of your investment portfolio. Additionally, there are no expenses associated with asset management or trading.

Find out more about M1 Finance right here.

Schwab

As a modern approach to investing and retirement, Schwab describes itself as a Schwab.

They’ve eliminated minimums and costs and provided investors with three different venues to invest. The Schwab Stock Slices, for example, are one of their distinctive offerings. Can purchase S&P 500 top firms for as little as $5 in fractional shares through these slices. Can assemble a pie of top-performing firms at a price that suits you by purchasing numerous slices at once.

Commission-free trading in stocks, options, and exchange-traded funds (ETFs) will appeal to investors of all experience levels.

Here, you may learn more about Schwab.

Betterment

Robo advisor investment platform Betterment is one of the most popular ones. They manage approximately $30 billion in assets for over 500,000 clients.

By asking a series of questions, Betterment, a robot advisor, learns about the investor’s risk tolerance and investment objectives. After that, it will suggest an ETF portfolio with low fees (ETFs). Accepting their proposal is one choice while customizing your portfolio is another.

Next, Betterment’s auto-rebalancing and tax-optimization tactics go to work on growing your money. One of the greatest investing applications for novices and experienced investors alike, this app provides a wealth of information at a fraction of the cost of standard investment services.

An increase in the number of socially responsible investment (SRI) options recently offered by Betterment has caught the eye of many investors. Two more SRI portfolios are available and the Broad Impact portfolio: Climate Impact and Social Impact. Investing in SRI-compliant securities lets, you put your money where your values are. Even if your goal is to make the world a better place, Betterment can help you do it.

Additionally, Betterment can help you manage your money more efficiently. In addition to a Cash Reserve account and a checking account, they offer cash management services.

Try it out here to see if Betterment is suitable for you.

Wealthfront

It’s no secret that Wealthfront is one of the most talked-about investment apps. Do you have any doubts about the value of Wealthfront? That’s what their half a million+ customers say! They presently manage over $470 billion in assets for over 470,000 clients.

Investors can choose from various passive and active investment solutions at Wealthfront. You can start an investment account with an expertly-designed portfolio for a passive approach. Start with a professional portfolio and make it your own if you’re ready to do it yourself.

Might incorporate the interests of investors into their investments. Wealthfront’s fund category selections include:

- Investing with a conscience

- Cryptocurrency

- Developing nations’ economies

- Cannabis \sTech

- The use of renewable resources

Wealthfront takes care of the rest after you’ve set up your portfolio. Their automated software handles everything from portfolio rebalancing to tax avoidance. The annual charge for this “set it and forget it” strategy is a modest 0.25 percent.

You may also look into their banking options and portfolio credit lines in addition to their automated investment software.

Ellevest

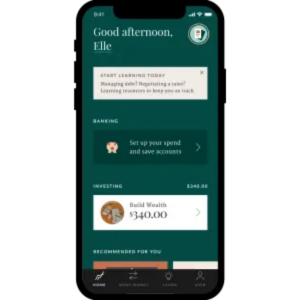

Money management has historically been a male-dominated field. Ellevest intends to rewrite history. Thanks to the resources women created for women, investing in women has never been easier. Women aren’t the only ones who can be clients!

Ellevest is in charge of more than $1 billion in assets. When it comes to gender-based investments, they do things a little differently. Because women tend to earn less money and live longer than males, they may have distinct financial demands. An investment algorithm tailored to the individual needs of Ellevest members is included in the membership fee.

Ellevest has three membership levels:

- Every month, you’ll pay just $1.

- Additionally, you’ll be charged an additional $5 every month.

- The monthly salary for an executive is $9,000.

Final Words on 2022’s Best Investing Apps

Just saving money isn’t enough. To see your money increase, you need to invest. Investing in applications and tools can help with that.

It doesn’t matter if you prefer to “set it and forget it” or trade actively; everyone has a strategy.