Understanding Stocks and Shares: A Comprehensive Guide for Beginners

Investing in the stock market can seem intimidating, especially if you’re just starting out. The world of stocks and shares is full of terms and strategies that might feel like learning a new language. But don’t worry—this guide is here to help you navigate the basics and make sense of it all.

If you’re considering share trading training in Bangalore or stock trading training in Bangalore, this article will provide a solid foundation. By the end of this guide, you’ll understand what stocks and shares are, how they work, and why they might be a good investment for you.Learn about stocks, shares, and the basics of trading. Explore stock market courses and stock trading training in Bangalore to get started.

1. Introduction to Stocks and Shares

Before we dive deep into the world of stocks and shares, let’s start with the basics. Have you ever wondered how companies raise money? Or how some people make a living by buying and selling shares? These questions lead us to the fundamental concept of stocks and shares.

Imagine owning a piece of your favorite company. Every time that company makes a profit, so do you. This is essentially how stocks work! It’s about owning a small part of a company and benefiting from its success.

2. What Are Stocks and Shares?

Stocks: Ownership in a Company

Stocks, sometimes called equities, represent ownership in a company. When you buy a stock, you buy a small piece of that company, known as a “share.” If the company does well and makes a profit, the value of your share might go up. Conversely, if the company struggles, the value of your share might go down.

Shares: Your Slice of the Pie

Think of shares like slices of a large pizza. Each slice represents a part of the whole pizza. When you buy shares, you’re buying a slice of that company. The more slices (or shares) you have, the larger your stake in the company.

3. How Does the Stock Market Work?

The Marketplace for Buying and Selling

The stock market is like a big, global marketplace where buyers and sellers come together to trade stocks. But instead of physical products, they trade ownership in companies.

When you hear about the “stock market going up,” it means that, overall, the value of stocks in the market is increasing. This is often seen as a sign of economic health and investor confidence.

The Role of Stock Exchanges

Stock exchanges are specific markets where stocks are bought and sold. Think of them like a farmers’ market, but instead of vegetables and fruits, they’re trading stocks and shares. Some well-known stock exchanges include the New York Stock Exchange (NYSE) and the National Stock Exchange of India (NSE).

4. Different Types of Stocks

Common vs. Preferred Stocks

Stocks generally fall into two categories: common and preferred.

- Common Stocks: These are the most typical stocks people invest in. They represent a share of ownership in a company and come with voting rights.

- Preferred Stocks: These don’t usually come with voting rights but offer a fixed dividend. This makes them less risky than common stocks, but they often have less potential for high returns.

Growth Stocks vs. Dividend Stocks

- Growth Stocks: Companies that reinvest their earnings back into the company rather than paying out dividends to shareholders. They’re great if you’re looking for long-term gains.

- Dividend Stocks: These are shares of companies that pay dividends—regular payouts to shareholders. They’re usually seen as safer investments and can provide a steady income stream.

5. Why Do People Invest in Stocks?

Potential for High Returns

One of the main reasons people invest in stocks is the potential for high returns. Over time, the stock market has historically provided higher returns than other types of investments, like bonds or savings accounts.

Diversification of Investment Portfolio

Investing in stocks allows people to diversify their investment portfolios. Diversification is like not putting all your eggs in one basket. By spreading out your investments across different stocks, you reduce the risk of losing everything if one stock performs poorly.

6. How to Buy and Sell Stocks

Opening a Brokerage Account

To start buying and selling stocks, you’ll need to open a brokerage account. A brokerage acts as a middleman between you and the stock market. You can open an account online through platforms like Zerodha, Upstox, or through traditional banks.

Placing an Order

Once you have a brokerage account, you can place an order to buy or sell stocks. There are different types of orders, like market orders (buy/sell at the current market price) and limit orders (buy/sell at a specific price).

7. Understanding Stock Prices and Values

Market Capitalization

Market capitalization, or “market cap,” is the total value of all a company’s shares of stock. It’s calculated by multiplying the stock price by the total number of outstanding shares. Companies are often categorized by their market cap, such as large-cap, mid-cap, and small-cap.

Price-to-Earnings Ratio (P/E Ratio)

The P/E ratio measures a company’s current share price relative to its per-share earnings. A high P/E ratio could mean the stock is overvalued, or investors are expecting high growth rates in the future.

8. Risks and Rewards of Stock Investing

The Ups and Downs of the Market

The stock market can be volatile. Prices can go up and down based on various factors, like economic news, interest rates, and even political events. While there’s potential for high returns, there’s also the risk of losing money.

Risk Tolerance and Investment Goals

Before investing, it’s important to understand your risk tolerance and investment goals. Are you investing for retirement, a down payment on a house, or just to grow your wealth? Knowing this will help you choose the right stocks and strategies.

9. Tips for New Investors

Start Small and Learn as You Go

If you’re new to stock investing, start small. You don’t need to invest a lot of money to start. Even a small investment can teach you valuable lessons about the market.

Do Your Research

Before buying a stock, do your research. Look into the company’s financials, its management team, and its industry. Understand what you’re buying and why.

10. The Role of Stock Exchanges

How Stock Exchanges Facilitate Trading

Stock exchanges facilitate the trading of stocks by providing a platform where buyers and sellers can meet. They ensure that trading is fair, transparent, and efficient. In India, the two main exchanges are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Listing Requirements and Regulations

For a company to be listed on a stock exchange, it must meet certain requirements and follow regulations. These rules help protect investors and ensure the integrity of the market.

11. What is Share Trading Training?

Learning the Basics and Beyond

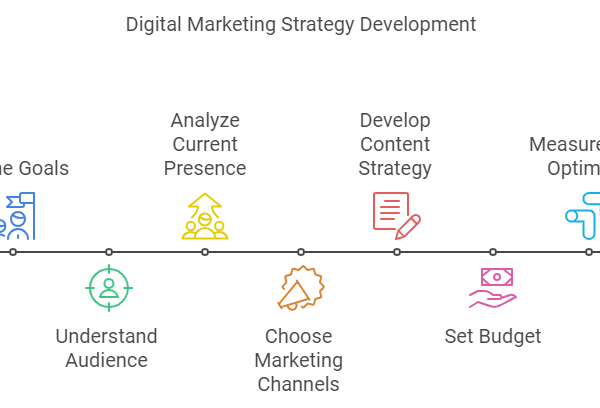

Share trading training teaches you the ins and outs of the stock market. From understanding stock quotes to analyzing market trends, a good course will cover all the basics and more.

Practical Skills and Strategies

These training programs often focus on practical skills and strategies, such as how to read financial statements, how to pick stocks, and how to manage risk. Some even offer paper trading, where you can practice trading without risking real money.

12. stock market course bangalore

Why Bangalore?

Bangalore, known as the Silicon Valley of India, is a hub for tech and finance. With a growing interest in investing and personal finance, the city has become a hotspot for share trading training. Many institutes in Bangalore offer comprehensive courses that cater to beginners as well as advanced traders.

Top Institutes Offering Training

Some of the top institutes in Bangalore offering share trading training include Online Trading Academy,Trendy Traders Academy . These institutes provide a range of courses, from basic stock market training to advanced technical analysis.

13. How to Choose a Stock Trading Course

Consider Your Learning Style and Goals

When choosing a offline trading classes near me stock trading course, consider your learning style and goals. Do you prefer online or in-person classes? Are you looking for a comprehensive course or something more focused? Understanding your needs will help you choose the right course.

Check Reviews and Credentials

Before enrolling in a course, check the reviews and credentials of the institute. Look for courses that are well-reviewed and offer a good balance of theory and practical application.

14. Frequently Asked Questions (FAQs)

1. What is the difference between stocks and shares?

Stocks and shares are often used interchangeably, but they have slightly different meanings. “Stocks” refer to ownership in a company, while “shares” refer to units of ownership in that company.

2. How much money do I need to start investing in stocks?

You don’t need a lot of money to start investing in stocks. Many brokerage accounts allow you to start with as little as INR 500 or 1000. The key is to start small and learn as you go.

3. Is stock trading risky?

Yes, stock trading involves risk. The value of stocks can go up or down, and there is always the possibility of losing money. However, by doing your research and understanding the market, you can manage and minimize those risks.

4. Can I invest in stocks without a broker?

Technically, no. To buy and sell stocks, you need to go through a broker or a brokerage platform. However, with online brokerage accounts, the process has become much easier and more accessible to everyone.

5. What are the benefits of taking share trading training in Bangalore?

Taking share trading training in Bangalore can provide you with the knowledge and skills to start investing confidently. Bangalore’s training programs offer practical insights, market analysis, and strategies tailored to different levels of expertise, making it a great place to start your trading journey.

15. Conclusion

Understanding stocks and shares is the first step to becoming a savvy investor. Whether you’re looking to grow your wealth, save for the future, or just learn something new, investing in the stock market can be a rewarding journey.

If you’re interested in diving deeper, consider exploring share market course in bangalore. With the right knowledge and tools, you can make informed decisions and achieve your financial goals. Remember, every expert was once a beginner, and the best time to start learning is now!