The North America anti-obesity drugs market is anticipated to grow at a CAGR of 9.30% from 2024 to 2032. This growth is propelled by the increasing prevalence of obesity and the demand for effective, low side-effect anti-obesity medications. This comprehensive analysis will explore the market dynamics, competitive landscape, emerging trends, regional analysis, regulatory framework, and future outlook of the North America anti-obesity drugs market.

Market Dynamics

Market Drivers

- Rising Prevalence of Obesity:

- Statistics and Trends: The obesity rate in North America has been on a consistent rise. According to the CDC, the obesity prevalence in the United States was 42.4% in 2017-2018. Canada and Mexico have also reported significant obesity rates.

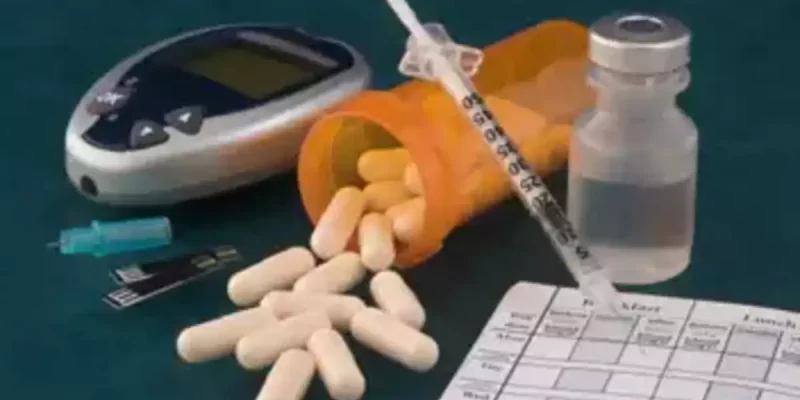

- Health Implications: Obesity is linked to numerous health conditions, including heart disease, diabetes, and certain cancers, increasing the need for effective treatment options.

- Growing Demand for Effective Drugs with Fewer Side Effects:

- Patient Preferences: Patients are increasingly looking for medications that not only aid in weight loss but also have minimal adverse effects, enhancing adherence to treatment.

- Innovation in Drug Development: Pharmaceutical companies are investing heavily in R&D to develop drugs that are more targeted and have fewer side effects.

Market Restraints

- High Costs of Anti-Obesity Drugs:

- Development Costs: The cost of developing new anti-obesity drugs is substantial, which translates into high prices for the end-users.

- Affordability Issues: High drug prices can limit access for many patients, particularly those without comprehensive health insurance.

- Stringent Regulatory Approvals:

- Regulatory Hurdles: Obtaining regulatory approval from bodies like the FDA and Health Canada is a rigorous process, often requiring extensive clinical trials and substantial evidence of efficacy and safety.

- Time-Consuming Process: The approval process can be lengthy, delaying the availability of new treatments.

Market Opportunities

- Advancements in Drug Development Technologies:

- New Drug Delivery Systems: Innovations such as sustained-release formulations and combination therapies are improving the effectiveness and patient compliance of anti-obesity drugs.

- Personalized Medicine: Advances in genetics and biotechnology are paving the way for personalized anti-obesity treatments tailored to individual patient profiles.

- Increasing Healthcare Expenditure:

- Government Initiatives: Governments are increasingly investing in healthcare infrastructure and obesity prevention programs.

- Insurance Coverage: Enhanced insurance coverage for obesity treatments is likely to increase patient access to anti-obesity drugs.

Market Challenges

- Side Effects of Existing Drugs:

- Adverse Reactions: Many existing anti-obesity drugs are associated with side effects such as gastrointestinal issues, cardiovascular problems, and psychological effects.

- Patient Adherence: The occurrence of side effects can lead to poor adherence to treatment regimens.

- Competition from Alternative Therapies:

- Surgical Interventions: Bariatric surgery and other surgical weight loss options are becoming more popular and can be seen as direct competition to drug therapies.

- Lifestyle Modifications: Diet and exercise regimens, often recommended as first-line interventions, can reduce the perceived need for pharmacological treatments.

Competitor Landscape

The North America anti-obesity drugs market features several key players who are actively engaged in research, development, and commercialization of anti-obesity medications. Here are the major companies:

- Pfizer, Inc.

- Key Products: Pfizer’s portfolio includes prescription drugs targeting obesity and related metabolic disorders.

- R&D Focus: The company invests significantly in research to develop novel anti-obesity drugs.

- Boehringer Ingelheim International GmbH

- Strategic Initiatives: Known for strategic collaborations and investments in cutting-edge research to tackle obesity.

- GlaxoSmithKline PLC

- Market Presence: GSK offers a range of anti-obesity medications and is a major player in the over-the-counter (OTC) segment.

- Novo Nordisk A/S

- Innovative Treatments: Novo Nordisk is recognized for its innovative treatments for diabetes and obesity, including GLP-1 receptor agonists.

- Rhythm Pharmaceuticals, Inc.

- Focus on Rare Conditions: Rhythm Pharmaceuticals focuses on genetic disorders of obesity, offering targeted therapies.

- Gelesis Holdings Inc. (PureTech Health)

- Unique Approaches: Gelesis develops therapies based on hydrogel technology for weight management.

- Currax Pharmaceutical LLC (Currax Holdings USA LLC)

- Comprehensive Solutions: Currax offers a range of pharmaceuticals addressing obesity and associated conditions.

- Vivus LLC

- Product Range: Vivus markets a variety of weight management solutions, focusing on appetite suppressants and combination drugs.

- Cheplapharm Arzneimittel GmbH (Braun Beteiligungs GmbH)

- Expansion Strategies: Cheplapharm is known for its strategic acquisitions and expanding its product offerings in the obesity segment.

- KVK Tech, Inc.

- Market Niche: KVK Tech specializes in manufacturing and distributing affordable generic anti-obesity drugs.

Market Trends and Developments

- Technological Advancements in Drug Development:

- Genetic Research: The integration of genetic research in drug development is leading to the creation of more effective and personalized anti-obesity treatments.

- Novel Drug Delivery Systems: Innovations such as transdermal patches and sustained-release formulations are improving drug efficacy and patient compliance.

- Emerging Trends in Drug Formulations:

- Combination Therapies: Combining different mechanisms of action in one drug is a growing trend, offering enhanced efficacy in weight management.

- Natural and Herbal Ingredients: There is increasing interest in incorporating natural and herbal ingredients into anti-obesity drugs to minimize side effects.

- Impact of Digital Health on Obesity Management:

- Telehealth Services: The rise of telehealth services is providing patients with easier access to obesity management programs and consultations.

- Mobile Health Apps: Mobile apps are becoming valuable tools for monitoring weight, diet, and physical activity, complementing pharmacological treatments.

Regional Analysis

The North America anti-obesity drugs market is segmented into the United States, Canada, and Mexico, each with unique market dynamics:

- United States:

- Largest Market Share: The U.S. holds the largest share of the North America anti-obesity drugs market, driven by high obesity rates and robust healthcare infrastructure.

- Government Initiatives: Various government programs aim to combat obesity through funding, research, and public health campaigns.

- Canada:

- Growing Market: Canada’s market is growing, supported by increasing healthcare expenditure and rising awareness of obesity-related health issues.

- Regulatory Environment: Health Canada’s regulatory framework ensures the safety and efficacy of anti-obesity drugs.

- Mexico:

- Emerging Market: Mexico is an emerging market with significant potential, driven by rising obesity rates and increasing healthcare investments.

- Healthcare Reforms: Ongoing healthcare reforms aim to improve access to obesity treatments and medications.

Regulatory and Reimbursement Scenario

Regulatory Framework

- FDA Guidelines (United States):

- Approval Process: The FDA requires rigorous clinical trials and comprehensive data to approve anti-obesity drugs, ensuring their safety and efficacy.

- Post-Marketing Surveillance: Approved drugs are subject to ongoing monitoring for adverse effects and long-term efficacy.

- Health Canada Regulations (Canada):

- Drug Approval: Health Canada’s approval process is similarly stringent, with a focus on patient safety and drug effectiveness.

- Compliance Requirements: Manufacturers must comply with strict guidelines to market anti-obesity drugs in Canada.

Reimbursement Policies

- Insurance Coverage:

- Private Insurance: Coverage for anti-obesity drugs varies among private insurers, with some offering comprehensive plans that include these medications.

- Government Programs: Programs like Medicare and Medicaid in the U.S. provide varying levels of coverage for obesity treatments.

- Government Initiatives:

- Subsidies and Grants: Governments may offer subsidies or grants to support obesity treatment programs and improve patient access to medications.

Strategic Recommendations

- Market Entry Strategies for New Players:

- Focus on Innovation: New entrants should invest in R&D to develop innovative drugs with unique mechanisms of action and minimal side effects.

- Strategic Partnerships: Forming partnerships with established companies can facilitate market entry and expansion.

- Strategies for Existing Players to Strengthen Market Position:

- Expand Product Portfolios: Diversifying product offerings to include a range of anti-obesity treatments can help maintain market leadership.

- Enhance Patient Support Programs: Offering comprehensive patient support programs can improve treatment adherence and outcomes.

- Investment Opportunities:

- Funding R&D: Investing in research and development of new anti-obesity drugs is crucial for long-term market success.

- Technological Integration: Leveraging digital health technologies can enhance patient engagement and treatment efficacy.