The digital age has brought about a plethora of conveniences, but it has also opened up new avenues for cybercrime. Among the many illicit activities that have emerged, the trade of dumps and CVV2 codes is particularly concerning. Platforms like Bclub cm play a central role in this underground economy. We’ll aim to shed light on the world of dumps, CVV2 shops, and their implications for credit card security, with a focus on Bclub cm.

What Are Dumps and CVV2 Codes?

Dumps are digital copies of the information contained in the magnetic stripe of a credit card. This data includes the card number, expiration date, and sometimes the cardholder’s name. Dumps are often obtained through skimming devices installed on ATMs or point-of-sale systems, or through data breaches at retailers.

CVV2 Codes (Card Verification Value 2) are three or four-digit numbers printed on the back of a credit card. They are used to verify that the cardholder has the physical card in their possession during card-not-present transactions, such as online purchases. Unlike the data in the magnetic stripe, CVV2 codes are not stored in merchant databases, making them harder to steal through conventional data breaches.

The Dark Side: CVV2 Shops

CVV2 shops are online marketplaces where cybercriminals buy and sell stolen credit card information, including dumps and CVV2 codes. These platforms provide a variety of services, such as validating card data and offering guarantees on the functionality of the sold information. The rise of such marketplaces poses significant risks to financial institutions and cardholders alike, as the traded data can be used to make fraudulent purchases or withdraw funds from accounts.

Bclub cm: A Central Hub in the Underground Economy

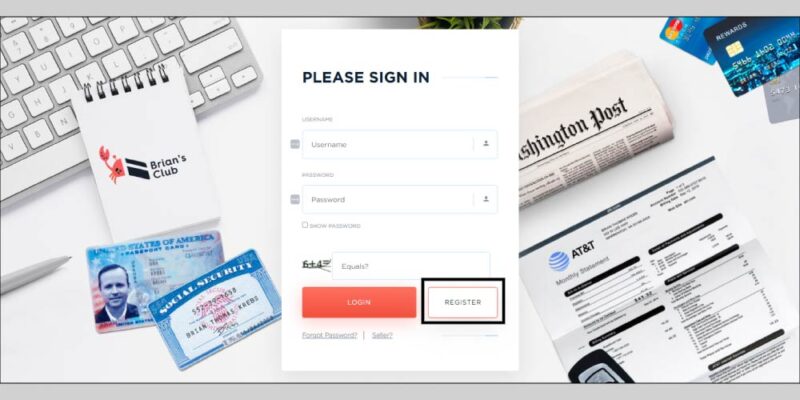

Bclub cm is one of the platforms known for facilitating the trade of dumps and CVV2 codes. It caters to cybercriminals by providing a user-friendly interface, comprehensive databases of stolen data, and maintaining anonymity through the use of cryptocurrencies for transactions. These features make Bclub cm a preferred destination for those looking to engage in credit card fraud.

Impact on Credit Card Security

The activities of platforms like Bclub cm have far-reaching implications for credit card security. Financial institutions must constantly evolve their security measures to protect cardholder information, while individuals need to remain vigilant to safeguard their financial data.

- Encryption and Tokenization: Financial institutions use encryption to protect card data during transactions. Tokenization replaces sensitive card information with a unique identifier (token) that is useless if stolen, thereby reducing the risk of data breaches.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security by requiring multiple forms of verification before granting access. This could involve something the user knows (password), something they have (smartphone), or something they are (biometric verification).

- Regular Monitoring and Alerts: Both institutions and cardholders should monitor account activities regularly. Setting up alerts for suspicious transactions can help detect and respond to fraudulent activities quickly.

Best Practices for Cardholders

Cardholders can take several steps to protect their financial information and minimize the risk of falling victim to fraud:

- Be Cautious with Online Transactions: Only make purchases from reputable websites. Look for secure connection indicators, such as HTTPS in the URL and padlock icons in the browser address bar.

- Avoid Public Wi-Fi for Transactions: Public Wi-Fi networks are less secure and more vulnerable to cyberattacks. Use a secure, private network when conducting financial transactions.

- Regularly Update Passwords: Use strong, unique passwords for online banking and shopping accounts. Change passwords regularly and avoid using the same password across multiple sites.

- Enable Transaction Alerts: Set up alerts for all credit card transactions to monitor for unauthorized activities. Immediate notification can help you act quickly to prevent further fraud.

- Review Statements Frequently: Regularly review your credit card statements for any unfamiliar charges. Report any discrepancies to your bank or card issuer immediately.

The Future of Credit Card Security

As cybercriminals continue to evolve their tactics, financial institutions and cardholders must stay ahead by adopting innovative security measures. The future of credit card security lies in continuous improvement and adaptation.

- Artificial Intelligence (AI) and Machine Learning: These technologies can analyze vast amounts of transaction data to identify patterns indicative of fraud. By learning from past fraud instances, AI systems can predict and flag suspicious activities with high accuracy.

- Biometric Authentication: Biometric methods, such as fingerprint scanning, facial recognition, and voice recognition, offer a higher level of security compared to traditional passwords and PINs. These methods are harder to replicate, providing a robust defense against unauthorized access.

- Blockchain Technology: Blockchain offers a decentralized and secure way to process transactions. Its transparent and immutable nature can enhance the security of financial transactions, making it harder for cybercriminals to tamper with data.

Conclusion

The digital landscape is continuously evolving, bringing both opportunities and challenges. Platforms like Bclub cm highlight the ongoing battle between cybercriminals and security professionals. By understanding the threats posed by dumps and CVV2 shops, and by adopting advanced security measures, both institutions and individuals can better protect themselves against financial fraud. Continuous education and vigilance are key to navigating this complex environment, ensuring that our financial information remains secure in an increasingly digital world.